Money laundering-it sounds like something out of a crime thriller, but the reality is far more complex and cleverly concealed. Behind the scenes of many criminal empires lies a sophisticated web of tricks designed to transform “dirty” money into seemingly legitimate cash. Ever wondered how illicit funds seamlessly re-enter the economy without raising a single eyebrow? In this article, we dive deep into the hidden world of money laundering, uncovering the ingenious strategies crime networks use to stay one step ahead of the law. Get ready to explore the secretive tactics that keep the underworld’s financial engine running smoothly-it’s as fascinating as it is alarming.

Table of Contents

- Unveiling Hidden Channels Where Dirty Money Flows Seamlessly

- How Layering Techniques Blur the Trail of Illicit Cash

- The Role of Shell Companies in Masking Criminal Profits

- Smart Strategies to Spot and Stop Money Laundering in Its Tracks

- Future Outlook

Unveiling Hidden Channels Where Dirty Money Flows Seamlessly

In the underbelly of global finance, crime syndicates exploit a labyrinth of obscure platforms and niche marketplaces to funnel illicit gains undetected. These channels, often disguised as legitimate business ventures or buried within the shadowy corners of the internet, enable easy conversion of dirty money into clean assets. The ingenious use of shell companies scattered across multiple jurisdictions, alongside cryptocurrency mixers and decentralized exchanges, creates a complex financial mirage that befuddles even seasoned investigators. This constantly evolving ecosystem thrives on anonymity, allowing criminals to weave an intricate web where money flows with unsettling fluidity.

But it’s not just digital frontiers where these covert methods take root. Traditional sectors have also become fertile grounds for laundering activities, with criminals capitalizing on gaps in regulatory oversight and leveraging layers of legitimate commercial activity. Common conduits include:

- Real estate investments, where inflated property values mask the origins of funds

- Luxury goods markets that facilitate rapid conversion through high-value transactions

- Offshore banking havens providing sanctuary with minimal reporting requirements

These hidden pathways, camouflaged by legal complexity and international borders, exemplify how seamlessly dirty money can be absorbed into the global economy. The challenge lies in unraveling these sophisticated methods without stifling legitimate cross-border trade and investment.

How Layering Techniques Blur the Trail of Illicit Cash

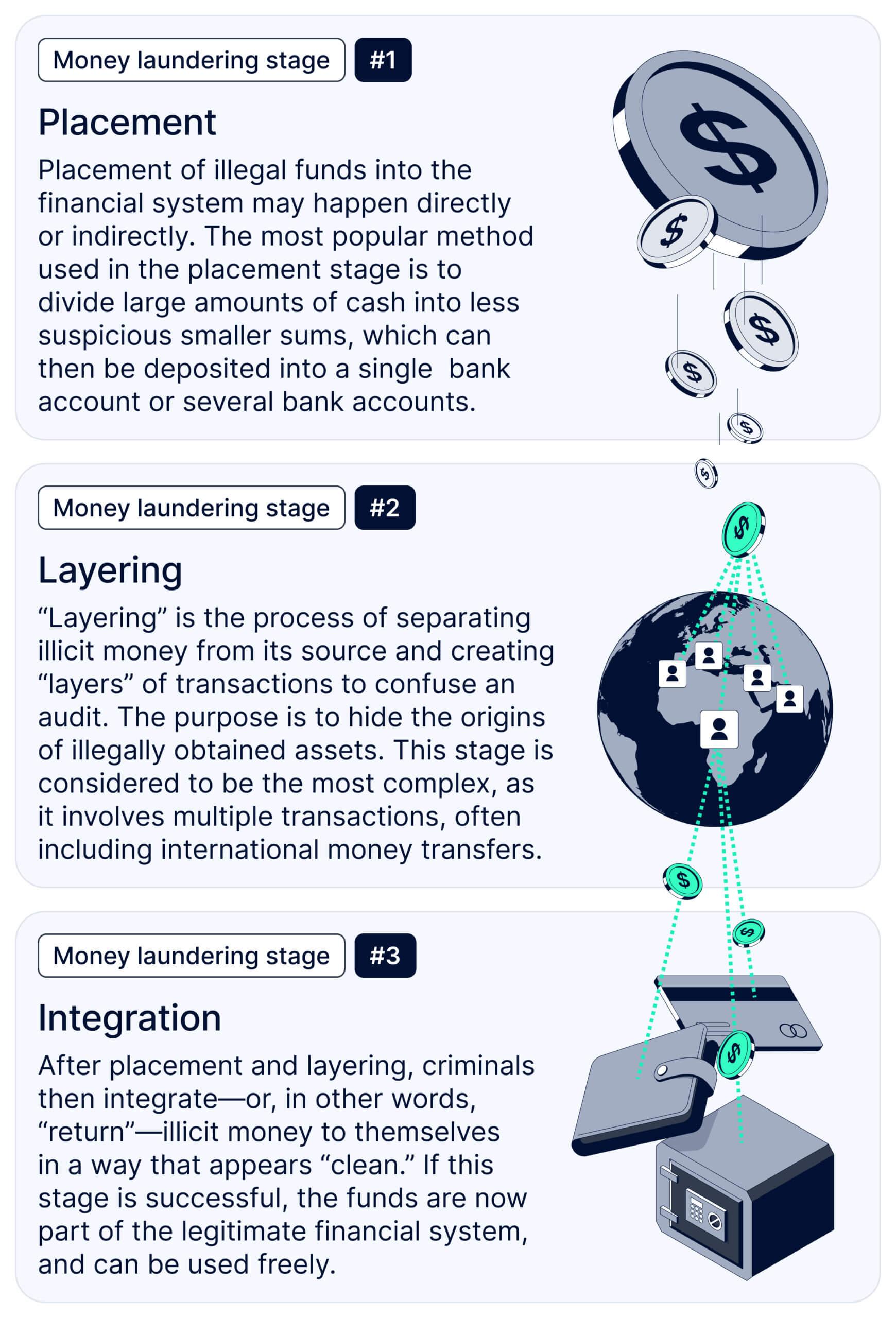

The core of money laundering’s sophistication lies in its ability to complicate the paper trail. By breaking down large sums of illicit cash into smaller, seemingly legitimate transactions, criminals create a maze that’s nearly impossible to trace. This process, often executed through multiple bank accounts and across different jurisdictions, effectively obscures the origin of the funds. Layering can involve subtle moves such as repeated transfers, currency exchanges, and investments in high-value assets, each step designed to distance the money from its criminal source.

Typical strategies within this phase include:

- Using shell companies that exist only on paper to funnel and disguise money flows.

- Frequent transactions between various accounts that mimic normal business operations.

- Purchasing and quickly reselling luxury goods to generate seemingly clean revenue.

- Exploiting offshore financial centers with lax regulations to hide ownership and control.

These tactics don’t just complicate financial investigations; they actively exploit gaps within global financial systems, turning the money laundering process into a perilous puzzle for authorities seeking to connect the dots.

The Role of Shell Companies in Masking Criminal Profits

Behind the shiny façades of countless shell companies lies a sophisticated façade designed to obscure the origin of illicit wealth. These entities, often incorporated in jurisdictions with lenient disclosure laws, act as the perfect smokescreen. Criminal networks cleverly leverage their anonymity, funneling dirty money through layers of transactions that seem perfectly legitimate on paper but are ultimately untraceable. By intertwining ownership among multiple shell companies, they create a labyrinthine structure that confounds even seasoned investigators, masking the true beneficiaries and origins with baffling complexity.

Common tactics include:

- Setting up multiple shell companies across different countries to exploit loopholes in international regulation.

- Using nominee directors and shareholders to hide the real masterminds behind these firms.

- Channeling illegal funds into fake invoices and contracts to simulate legitimate business activities.

- Employing rapid and circular financial transfers that blur the money trail.

By mastering these strategies, criminal enterprises not only protect their profits but also ensure that even if one shell company is exposed, the entire network remains intact and elusive.

Smart Strategies to Spot and Stop Money Laundering in Its Tracks

Understanding the cunning methods used by criminal masterminds to disguise illicit funds is crucial in safeguarding the financial ecosystem. They often layer transactions to create complex webs that conceal the original source of money, making detection a formidable challenge. Look for patterns like rapid movement of funds across multiple accounts or unexplained cash deposits that don’t align with the client’s profile. Financial institutions increasingly deploy AI-driven systems that not only monitor transactions in real-time but also learn from evolving laundering tactics, enhancing their ability to flag suspicious activities more swiftly and accurately.

Equally important is the collaboration between agencies and sectors. Sharing intelligence through secure channels illuminates the hidden connections that individual players might miss. To sharpen your vigilance, consider these key tactics:

- Know Your Customer (KYC) processes: Deep dive into client backgrounds and continuously update records to spot inconsistencies early.

- Transaction Monitoring Systems: Utilize automated tools capable of flagging anomalies, such as round-dollar transactions or unusual geographic flow.

- Staff Training: Equip teams with the latest signs of laundering so they can detect subtle red flags promptly.

- Cross-border Coordination: Maintain active partnerships with international authorities to dismantle laundering schemes that span multiple jurisdictions.

Future Outlook

As we peel back the layers of these cunning money laundering schemes, it’s clear that crime networks are constantly evolving, staying one step ahead of the law. Their creativity and adaptability make unraveling these financial webs a challenging puzzle. But by staying informed and curious, we can better understand the forces at play-and why cracking these operations is so crucial to maintaining the integrity of our global economy. Keep watching this space for more deep dives into the hidden world of financial crime. Who knows what other clever tricks we’ll uncover next?