Ever wondered what makes pyramid schemes so tempting — and so dangerous? These elusive setups promise quick riches and endless growth, drawing in hopeful dreamers with dazzling tales of success. But beneath the glossy surface lies a fragile structure doomed to collapse. In this blog, we’re diving deep inside a pyramid scheme to unravel how it really works, why it captivates so many, and, ultimately, why it’s destined to fail. Ready to uncover the truths behind the hype? Let’s get started!

Table of Contents

- Understanding the Building Blocks of a Pyramid Scheme

- The Hidden Mechanics That Keep the Scheme Running

- Why the House of Cards Inevitably Collapses

- Smart Moves to Protect Yourself from Falling In

- To Conclude

Understanding the Building Blocks of a Pyramid Scheme

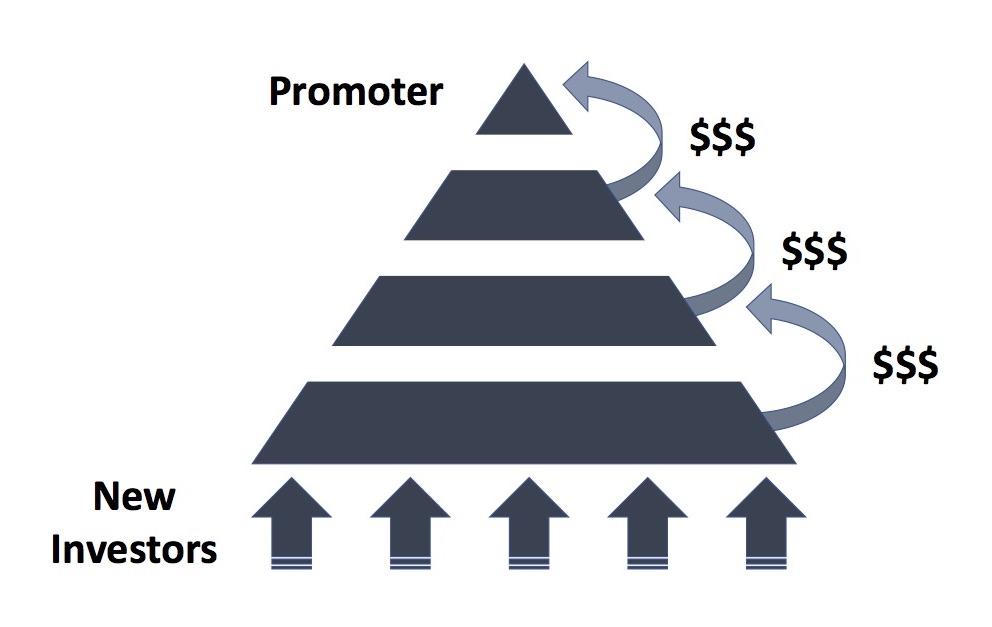

At their core, pyramid schemes depend on a deceptively simple structure: new participants recruit others into the scheme, creating multiple “layers” beneath them. Each layer funnels money upward, rewarding those at the top with cash flow generated by fresh recruits at the base. Unlike legitimate businesses that generate revenue through the sale of real products or services, the only income in a pyramid scheme comes from signing up new members. This creates the illusion of wealth and growth, but it’s all built on the unstable foundation of constant recruitment.

The key components that make pyramid schemes both enticing and dangerous include:

- Exponential growth requirement: each participant must bring in multiple recruits, leading to rapid expansion demands.

- Lack of genuine product or service: money flows internally rather than from outside sales.

- Artificial compensation plans: designed to heavily favor early entrants while almost guaranteeing losses for the majority.

This fragile setup means the scheme’s sustainability is tied to an ever-increasing number of new joiners, which inevitably leads to collapse when recruitment stalls.

The Hidden Mechanics That Keep the Scheme Running

At the heart of the scheme lies a deceptively simple system that banks on relentless recruitment rather than product sales. Participants are enticed with promises of exponential returns, but the real “currency” they trade is new recruits. Each new member pays an upfront fee or investment, a portion of which trickles up through the layers of the pyramid, rewarding early entrants disproportionately. This creates an illusion of a self-sustaining cash flow — but in reality, it’s a fragile house of cards built entirely on continuous sign-ups.

The operational mechanics can be summarized by a few core dynamics:

- Recruitment Dependency: Without an endless stream of newcomers, income seizes to exist.

- Incentive Layers: The higher up the pyramid you are, the more you earn from those below.

- Lack of Genuine Product Demand: Often, products serve only as a disguise, lacking intrinsic value or market demand.

These hidden mechanics ensure that while a few early players profit handsomely, the vast majority at the base end up losing their investments, feeding a cycle doomed by its own structure.

Why the House of Cards Inevitably Collapses

At the heart of every pyramid scheme lies a fatal flaw: the relentless need for exponential recruitment. Early participants may bask in the illusion of wealth, but as the base expands, the pool of new recruits inevitably shrinks. This mathematical impossibility means that sooner or later, fresh members become scarce, and the promised returns start to dry up. The structure, much like a house of cards, can only stand tall if there’s constant support from below. Once that support wavers, the whole façade crumbles — leaving the majority stranded with losses and dashed hopes.

Beyond the numbers, the psychology driving these schemes also accelerates their downfall. They prey on optimism and social pressure, weaving narratives of quick riches and exclusive opportunities. Yet, as disillusionment spreads, trust erodes and the once tight-knit network begins to unravel. Key signs of an imminent collapse often include:

- Delayed or denied payouts to new recruits

- Increased secrecy and changes in recruitment tactics

- Fragmentation of early participants chasing scarce rewards

These cracks appear quickly and spread rapidly, making the structural failure not just inevitable, but almost immediate once recruitment stalls.

Smart Moves to Protect Yourself from Falling In

Knowing the red flags to watch for can be a game changer when you’re trying to steer clear of these traps. Always be wary of offers that promise excessive returns with little to no risk—if it sounds too good to be true, it probably is. Pay attention to the structure of the opportunity: if the emphasis is primarily on recruiting others rather than selling an actual product or service, it’s a glaring warning sign. Don’t hesitate to dig deeper and ask questions about how the money really flows. Legitimate ventures have transparent, understandable business models, so if someone’s reluctant to provide clear answers, consider that a huge red flag.

Building a strong defense starts with knowledge and a healthy dose of skepticism. Here are some practical takeaways you can keep in your back pocket:

- Research the company: Look beyond their website—check reviews, ratings, and legal filings.

- Question recruitment pressure: If you’re being pushed to bring in others quickly, step back and evaluate.

- Ignore hype: Flashy presentations and promises of quick success often mask the unsustainable realities.

- Consult trusted advisors: Before investing, get opinions from financial experts or those with experience.

To Conclude

Peeling back the layers of a pyramid scheme reveals a fascinating—and cautionary—look at how promises of easy riches can mask an inevitable collapse. While the allure of quick profits is hard to resist, understanding the mechanics behind these schemes is key to spotting them before they catch you in their web. So next time someone offers a “can’t-miss” opportunity that hinges on recruiting others, remember: if it looks like a pyramid scheme, it probably is. Stay curious, stay informed, and keep your financial footing secure.